Tin prices have been supported in recent years by surging electronics demand amid a deficit in supply.

In 2024’s second quarter, the metal hit a two year high when it moved above US$35,000 per metric ton (MT).

“Top exporter Indonesia triggered concerns of tight supply globally as licensing delays sharply impacted first-quarter deliveries, magnified by worries of future licensing disruptions for the rest of the year,” Trading Economics reported in late May, outlining the sector’s supply/demand dynamics. ‘This compounded previous production setbacks, headlined by mining disruptions in the Wa State of Myanmar amid the country’s war.”

In addition, signs of rebounding Chinese demand and the need for tin’s soldering properties in infrastructure and artificial intelligence (AI) chip are prompting bullish sentiment for the metal.

Tin is primarily used to coat other metals due to its ability to retain a high polish and prevent corrosion. Tin is also an alloy metal used in soldering and the production of rare earths superconducting magnets.

What factors impact tin supply and demand?

The tin market has been in deficit for the past decade, and supply is expected to remain constrained as demand rises.

Tin’s positive characteristics mean it has a slew of important uses. For example, the metal is malleable, ductile and not easily oxidized in air; it’s also lightweight, durable and fairly resistant to corrosion.

Those qualities make tin, which is obtained from the mineral cassiterite, a good candidate for use in solder, as well as tinplate, chemicals, brass and bronze and other niche areas.

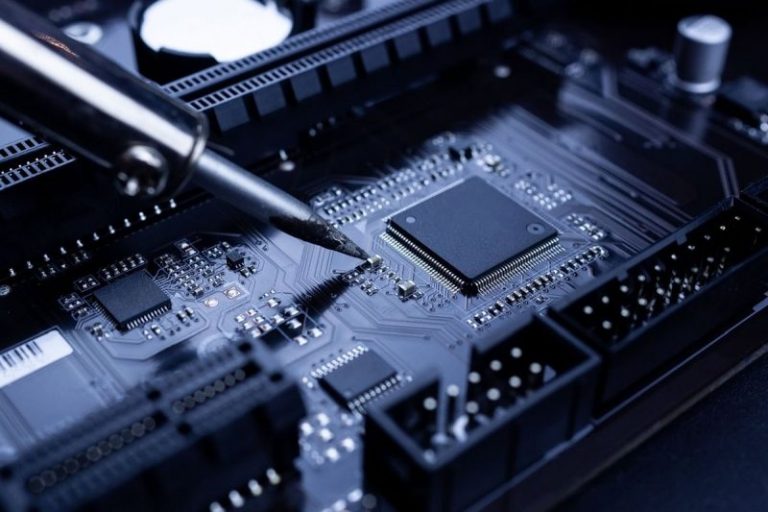

Today the electronics industry is the sector to watch for investors who are keeping an eye on tin. The metal is used in semiconductor circuit-board soldering, an application that accounts for about half of global tin consumption. As electronics become more advanced, they require more semiconductor chips, and hence, more tin. AI chips are especially complex and represent an emerging source of increased demand for the metal.

‘The development of AI equipment requires the use of specialized semiconductor chips — graphic processing units (GPUs) — which use tin as both a solder and as anti-corrosion protection within circuit boards,’ according to Fastmarkets.

Keeping an eye on supply disruptions out of important tin-producing jurisdictions is also key. In terms of where tin is produced, China was the world’s top tin producer in 2023; the country put out 68,000 MT of the metal.

Myanmar is behind China at 54,000 MT, and third on the list is Indonesia at 52,000 MT. Peru and the Democratic Republic of Congo (DRC) are next with 23,000 MT and 19,000 MT, respectively. Total world output for the year was 290,000 MT, down by 17,000 MT from the previous year, and world tin reserves sit at 4.3 million MT.

The most recent tin supply constraints are coming out of delays in export licensing in Indonesia, mining disruptions at Myanmar’s Man Maw mine and escalating violence in the DRC. Like tungsten, tantalum and gold, tin is a conflict mineral. Armed groups in the DRC earn hundreds of millions of dollars every year by trading these minerals.

Currently, the Dodd-Frank Act in the US requires public companies that source minerals from the DRC to produce independently audited reports about the ownership and origin of these mined commodities; these documents must be provided to the US Securities and Exchange Commission.

Paying attention to tin inventory changes on the London Metal Exchange (LME) is also a good strategy for gaining insight on tin market developments. As the bullish story for tin develops, speculative buying has increased on the LME. The result is that headline tin stock levels on the exchange dropped by 46 percent between the beginning of 2024 and mid-April, coinciding with the two year price high for the metal.

What are the ways to invest in tin?

As mentioned, investing in tin is becoming more and more appealing as demand for the metal grows.

Those wishing to begin tin investing may want to consider tin futures, which are traded on the LME under the code SN, with contract pricing in US dollars per MT. Clearable currencies include the US dollar, yen, pound and euro.

Of course, tin investing can also be done by buying shares of tin-focused companies, such as the world’s top tin-producing companies, which include China’s Yunnan Tin (SZSE:000960), Indonesia’s PT Timah (IDX:TINS) and Malaysia’s Malaysia Smelting (SGX:NPW) — click here for the full list.

Smaller-scale tin miners include Metals X (ASX:MLX,OTC Pink:MLXEF) and Alphamin Resources (TSXV:AFM,OTC Pink:AFMJF). Metals X has a 50 percent stake in Renison, Australia’s largest tin-producing mine. Located in Tasmania, the mine produced 9,532 MT of tin in 2023. Low-cost tin concentrate producer Alphamin Resources reportedly accounts for about 4 percent of global tin mine supply. It operates the high-grade Mpama North tin mine in the DRC. The mine has an annual output of approximately 10,000 MT of contained tin. Alphamin is on track to bring its new Mpama South tin concentrate plant into production in the first half of 2024.

Exploration and development-stage tin projects are relatively rare, but investors do have some options, such as UK-based Cornish Metals (TSXV:CUSN,LSE:CUSN), whose flagship asset is the advanced-stage South Crofty tin project in Southwest England. It has existing mine infrastructure in place, as well as an active mine permit.

An April 2024 preliminary economic assessment for South Crofty shows a base case after-tax net present value (NPV) of US$201 million and an internal rate of return (IRR) of 29.8 percent.

There’s also Elementos (ASX:ELT), which owns two tin projects: the Cleveland tin project in Tasmania, Australia, and the Oropesa project in Spain. The company is on track to complete a definitive feasibility study (DFS) for Oropesa by 2024’s fourth quarter and is aiming to bring the project into commercial production by Q4 2027.

First Tin (LSE:1SN) is also advancing tin projects in both Australia and Europe. A May 2024 DFS for the Taronga tin project in Australia shows a CAPEX of AU$176 million with base case pre-tax NPV of AU$143 million and an IRR of 24 percent. At its Tellerhäuser project in Germany, First Tin is working toward an updated mineral resource estimate.

In Western Tasmania, Stellar Resources (ASX:SRZ) is developing its high-grade Heemskirk tin project, which it plans to power via renewable energy sources, including hydro and wind. A 2019 scoping study for Heemskirk highlights a 350,000 MT per annum underground mine and an on-site processing plant. Currently the company is working to update the study based on its September 2023 mineral resource estimate.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.